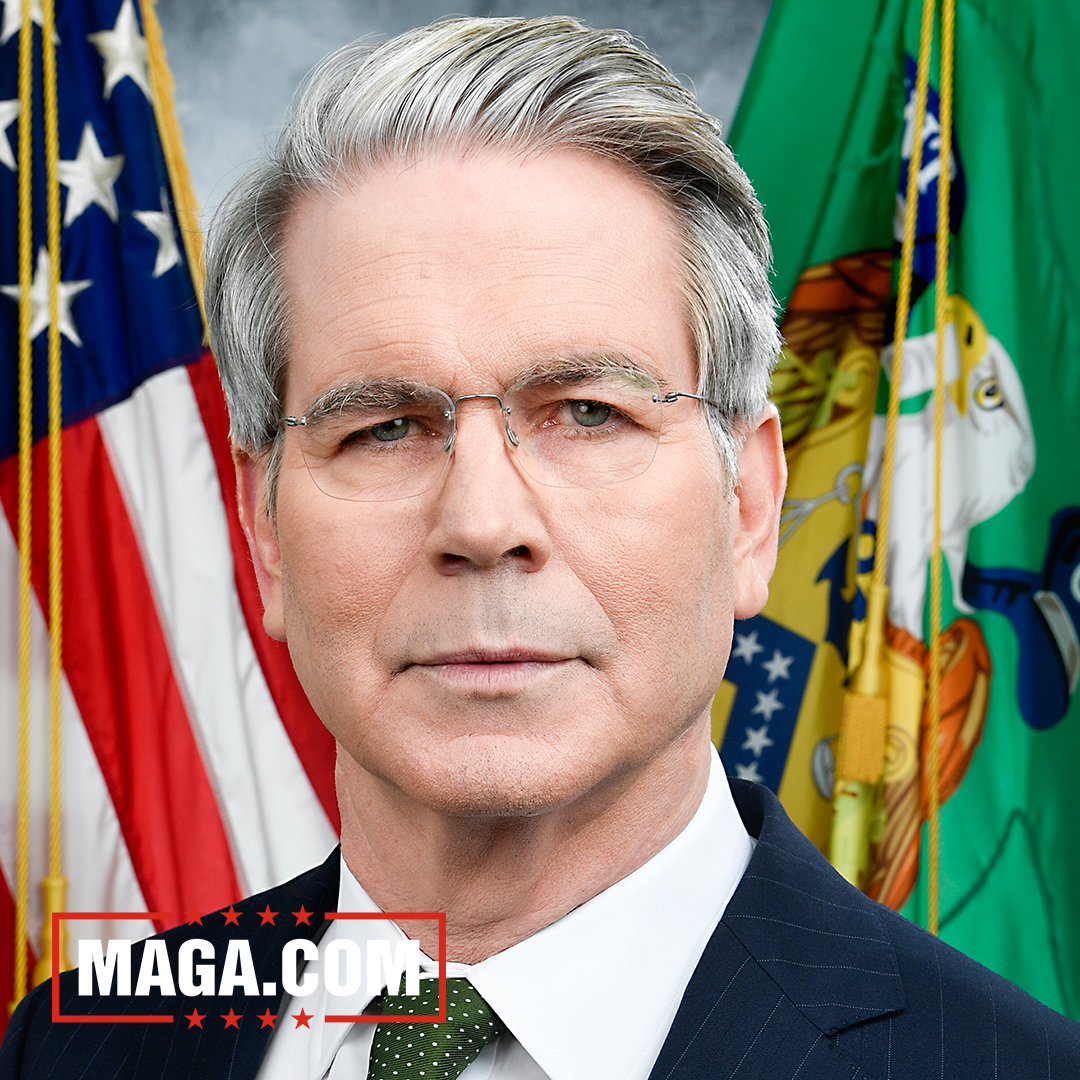

Treasury Secretary Scott Bessent is currently helping lead President Donald Trump’s administration’s efforts to address the affordability crisis that voters have expressed concerns about ahead of the 2026 midterm elections.

The New York Post reported that while Bessent has claimed that the Trump administration’s tariff policies will ultimately result in the return of domestic manufacturing in the United States, a recent Bank of America report obtained by the outlet claimed that there is “no debate” that “tariffs have pushed consumer prices higher” for Americans.

According to The New York Post, economic experts have warned that the Trump administration’s tariff policies could result in stagflation, as increased prices could slow economic growth in the United States.

In a recent analysis of the U.S. economy, the Royal Bank of Canada stated, “Heading into 2026, we see a US economy that is increasingly on track for a stagflation lite scenario.”

“Tariffs will weigh on the labor market and put upward pressure on inflation,” the Royal Bank of Canada added. “Our concern remains that we have yet to see the full pass-through of tariffs to consumer goods prices.”

Despite concerns regarding the Trump administration’s tariff policies, Bessent has suggested the Trump administration’s policies are critical to countering China and that tariffs will gradually disappear like “a shrinking ice cube” as the United States increases domestic manufacturing, according to The New York Post.

On Friday, the Bureau of Economic Analysis released a report that showed consumer spending increased by 0.3 percent in September, following three months of larger economic gains.

In a statement obtained by The New York Post, James Knighley, ING Bank’s chief international economist for the Americas, said, “Middle and lower-income households remain worried about their prospects, as underscored by weak consumer confidence and anxiety over job security.”

During a Sunday interview on CBS News’ “Face the Nation with Margaret Brennan,” Bessent provided a positive update on the economy in contrast with recent concerns from voters ahead of the 2026 midterm elections.

“The economy has been better than we thought. We've had the 4- 4% GDP growth in a couple of quarters,” Bessent said. “We’re going to finish the year, despite the Schumer shutdown, with 3% real GDP growth.”

“Interest rates have come down,” Bessent added. “The bond market just had the best year since 2020 and now we are working on inflation, and I expect inflation to roll down strongly next year.”

Share:

Video: Top Democrat gives Trump 'credit' for securing the border

Videos: Trump awarded first FIFA Peace Prize